Coffee Market Comments: The Ripple Effect of COVID-19

The Outbreak of COVID-19

Over the past few weeks, the Conservative Government has enforced unforeseen measures comparable to those imposed during World War II. Boris in place of Winston, and COVID-19 in place of Fascism. Admirable and amiable leaders in their own special way, both of whom were, and are, faced with diseases that threaten life as we know it. Yet I find it strange how many of us, including myself, are astounded and shocked by the current situation we find ourselves in. First signs of the outbreak date back to mid-November, with the World Health Organisation first reporting an unknown virus affecting the population of Wuhan on 31.12.19. Exactly one month later, China had 11,791 cases comparative to 571 accounted for on 22.01.20. To date, China has 81,740 known cases with 3,331 deaths. But despite warnings of COVID-19s aggressive nature, the West seemingly adopted an ‘out of sight, out of mind’ attitude that I can only imagine stemmed from the days of SARS and it’s containment within Asia. Obviously the severity of the situation has dawned on us now, but for months, we were happy to sit back with folded arms and watch Rome burn….

As COVID-19 spread West, markets in London and New York, well across the globe in fact, suffered their worst run of trading since the Financial Crisis of 2008. Dated 16.03.20, the Dow Jones Industrial Average suffered its worst day since the Black Monday crash of 1987. Yet the Coffee ‘C’ futures market traded in New York rallied to a two month high of $130 cts/lb on 26.03.20. Dating back to the beginning of February, the market traded at a miserable $97 cts/lbs. In an attempt to remain productive during these extraordinary times, I wish to explore this price jump, and the effect that COVID-19 is having on both the specialty coffee market and the wider commodity market. One immediate explanation focuses on the supply of coffee to the globe; as COVID-19 spreads through coffee producing countries, concerns over disrupted harvests and transportation links to consuming countries will inevitably result in an undersupply of coffee. The counter argument would suggest that continued lockdown measures in consuming countries will apply downward pressure on the market as demand dwindles. Considering the transparency that importers have throughout the coffee supply chain, we are well positioned to comment on COVID-19s immediate impact, and to speculate on the ripple effect for months to come.

Coffee On the High Street

On 20.03.20, Boris instructed for ‘non-essential’ businesses to close their doors. Arguably the hospitality industry has been the hardest hit, with the once burgeoning coffee scene devastated. Those who had built wholesale models focusing on the HORECA market have been faced with the task of restructuring every facet their business, resulting in widespread furloughing of staff and closures. The majority have had to rapidly adapt, channelling resources towards e-commerce. We’ve received news of varying success stories, and have even heard whispers of a handful of specialty roasteries who are thriving, tripling in production as their customer base further explore the realms of home brewing. Again, a handful who have established relationships with supermarkets are quietly confident that they will come out the other side relatively unscathed.

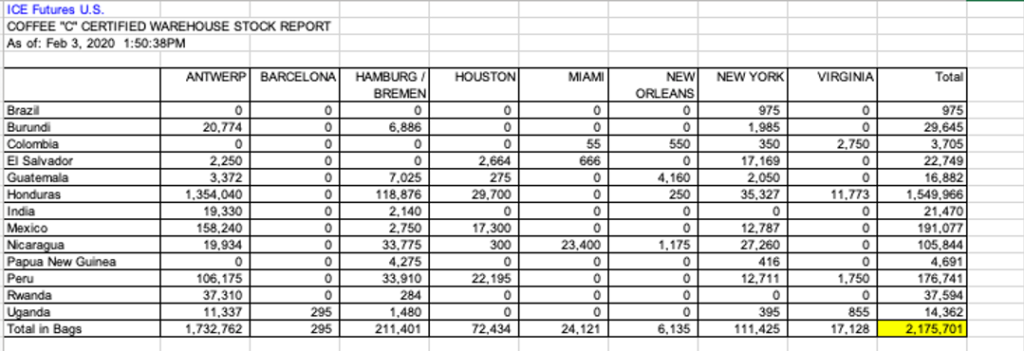

Regarding the wider commodity coffee market, reports from the continent imply that the international trade houses are busier than ever as large commercial roasters scramble to stock pile reserves. Albeit strange considering the fall in demand for out-of-home consumption, the threat of major disruptions at Origin has resulted in a spurt of buying. As the globe tackles COVID-19 one day at a time, the months ahead are unchartered waters for every agent within the coffee market. For large commercial roasters, contingency planning is a necessity as requirements for retail and wholesale clients still operating need fulfilling. In turn, this has led to drawdowns from warehouses across Europe and the US evident in comparing daily warehouse stock reports available via the ICE Report Centre:

Daily Warehouse Stock Report 03.02.20:

Daily Warehouse Stock Report 27.03.20:

Over the course of two months, stock levels have decreased by 167,840 bags, with one Geneva based trade house suggesting that the total number of bags on the exchange will fall to 1.1 million come September. Depleting reserves of deliverables available on the exchange and evidence of major supply chain disruptions are two key fundamentals driving a long-overdue bullish trend in the Coffee ‘C’ futures market. You’ll notice in the report above that Honduras commands the lion share when it comes to volume stored in certified warehouses, with 1,466,882 bags dated 27.03.20. The Honduran Government also declared a State of Emergency on 16.03.20, closing the port of Puerto Cortes and therefore cutting off the supply. One can draw a correlation between COVID-19’s effect on the supply of Origins which previously flooded the market and fluctuations in the price of the ‘C’ Contract.

Yet the overbearing fear of weakening demand in consuming countries has seemingly cooled the spurt in buying. The price of the ‘C’ contract dated 27.03.20 traded at a day’s low of 115.85 cts/lbs, with continued lockdown measures applying downward pressure on the market. As the virus spreads within coffee producing countries, will we see another price spike as mills, ports, and transport links close completely? As the rate of infection slows in Europe, combined with the lifting of restrictions allowing cafes and restaurants to open again, will we see another round of panic buying? One can only speculate, but the volatility of the ‘C’ futures market is clearly evident during these unprecedented times.

Importers of Specialty Coffee

Unlike the trade houses operating within the realms of commodity coffee, importers of specialty coffee are part-removed from the volatility of the ‘C’ futures market due to the ‘direct’ nature of their purchasing models. Long term relationships established over time with producers and exporting partners enables an honest and open negotiation over an outright price based on the quality of the cup. Although price discovery for specialty grade coffee stems from the ‘C’ futures market, the form in which it is traded i.e. directly, protects producers and importers alike from fluctuations in the ‘C’ contract. At the point of purchase, both parties can agree on the ‘right price’ for a lot based on the quality of the cup. This price will most likely be a very similar comparatively to the price agreed upon in the years prior. The ‘C’ futures market has been subject to much criticism since inception, and much more so in recent years. Since March 2018, the ‘C’ has barley traded over $120 cts/lbs; a price far from a sustainable level. The benefits of producing and importing specialty coffee are further evident during periods of high volatility such as these.

Despite this, importers of specialty coffee are still faced with the very daunting challenge in managing the knock-on effects of COVID-19. As previously mentioned, quality is imperative when referring specialty coffee. Market demand and customer requirements are carefully calculated prior to purchasing from the year’s harvest in order to avoid lingering, ageing stock. With demand dropping off a cliff edge quite literally over the course of a couple of weeks, and with warehouses filled to the brim with 19/20 harvest, importers are heavily exposed to the risk of overstock. No matter which perishable good you are trading, failure to shift stock will eventually culminate in a catastrophic back log that will wreak havoc on one’s bottom line and one’s cash flow for years to come. With coffee, this back log trickles right back down to the producer, with importers defaulting or delaying contracts as roasters fail to drawdown stock currently in store.

Exposure to the risk of ageing stock is prevalent, but with the correct sales strategy, and the potential lifting of lockdown measures in the near future, loses can be mitigated. ICONA Café noted that despite significant reduction in ‘out-of-home consumption’, consumers in mature markets have the ‘ability to replace out-of-home with at-home consumption.’ The latest reports from China also suggest that there’s light at the end of the tunnel. The Chinese Government intends to ease lockdown measures imposed at the epicentre of the virus on 08.04.20. The re-opening of coffee shops, despite reduced footfall, will eventually resuscitate dormant wholesale accounts. Combined with emergency packages provided by respective Governments and with the careful management of cash-flow, importers should, in theory, be able to weather the storm.

At Origin

The effect of COVID-19 on Origin operations and exports varies across the board depending on harvest period and lockdown measures imposed by respective Governments. For example, having spoken to one of the largest producers in Costa Rica, an early harvest in 2019 kickstarted sales, and in turn shipments, prior to lockdowns across the US and Europe. In comparison, the harvests in other Central American countries such as Guatemala, El Salvador, and Honduras are coming to an end. At this crucial point in time whereby the coffee cherry is arriving at the mills, offer samples dispatched, and contracts confirmed, the impact of COVID-19 has stalled the entire process. A critical aspect of the lockdown measures being the ban on travel effectively bringing the transportation of coffee to a standstill. As mentioned previously, the Honduran Government has closed all borders including roads, airports, and ports for 15 days. However, even if exporters were able to move coffee to the ports, a shortage of empty containers returning to Origin is further compounding delays. Logistic reports from Brazil, the largest coffee producing country globally, estimates that it will take 4 months to realign container schedules.

Combined with major transport disruptions, the lack of pickers for current and upcoming harvests is also a concern. As unprecedented measures are imposed to flatten the curve, exporters and producers are faced with no other option but to close down operations, or continue as best as possible with what they have. For example, in Colombia, with the Mitaca harvest in full-swing, exporters foresee that they will not have the necessary labour force to move coffee from the fields. Even with the ability to do so, exporters and producers are unable to gauge future demand as importers delay shipments pending roaster demand and the lifting of lockdown measures. From a wider social perspective, the inability to travel to work or pickers staying at home due to the fear of contracting COVID-19 is a disaster. Over 50% of employment in Colombia is informal, meaning that there is no set income for occupations such as coffee pickers. The absence of social security for informal workers means that if lockdown measures persist, the long-term impact on social structures within Colombia will be devastating.

It’s really too early to accurately determine the long term implications that this pandemic will cause on the supply side as a whole. The panicked spurt in buying by the larger commercial roasters during the first few weeks of lockdown has now ceased as baseline volume forecasts are adjusted to meet at-home consumption. The same applies to boutique specialty roasters. Referring back to the Coffee ‘C’ futures market, the overall decline in demand in coffee consuming countries is currently outweighing concerns over supply. The latest report from Rabobank estimate a ‘cut in the rate of global demand growth from 2.5% in calendar year 2019 to 0.4% in 2020, similar to what we saw during the 2008/09 crisis.’ Having said that, the worst is yet to come for the likes of major producing countries such as Brazil, Colombia, Peru, and Honduras. At the time of writing, Brazil has 12,232 confirm Coronavirus cases with 566 deaths. The fact that President Jair Bolsonaro continues to ignore isolation measures advocating that Brazilians should go about business as usual is worrying at best. Mindless strategies such as this will inevitably exacerbate the impact of COVID-19. Speculators forecasting further disruptions at Origin, combined with the eventual lifting of lockdown measures in coffee consuming countries should support the bullish trend evident over the course of the past two months. With the World hoping to look back in the near future on the start of 2020 as a write off, the silver lining to the darkest of clouds is a long overdue rise in the price of the ‘C’ Contract.

A Collective Solution

We are watching and trying to comprehend a range of inputs; a near total collapse of out-of-home consumption, major supply disruptions, wild forex fluctuations, political interventions, dangerously high stock to sales ratios, as well as focusing on the core ingredients of importing specialty coffee; quality, sustainability, and relationships. Attempting to quantify the impact that the ripple from Wuhan will have on our industry is nigh on impossible. The months ahead are uncertain at best, but there are signs of improvement coming down the tracks. Based on the timescale of the curve in China, Q3 will be a critical recovery quarter to watch. From an importers perspective, it falls on the shoulders of the sales teams to further nurture established channels and more importantly, develop new ones. The exposure to the risk of ageing overstock is critical, and its impact will be lethal if left unaddressed.

But for now, and more importantly so, industry solidarity is fundamental to our future. Many specialty importers are blessed in being situated in mature markets where wealthy Governments are able to provide financial support to businesses. This is not the case for many coffee producing countries. Importers and roasters alike must support businesses within developing nations who lack the infrastructure to do so. It’s the responsibility of the more fortunate to honour commitments to contracts already agreed upon and continue to work with their partners at Origin to the best of their abilities. Importers will weather the storm, but COVID-19 will devastate coffee producing countries beyond imagination without the support of the wider community. The greatest challenge facing our industry will be to deliver true solidarity.